|

By: Security Bank Team The Philippine real estate market is projected to soar higher this year. Developers remain optimistic that a continuous incline in saving and income–especially in the middle class–will stimulate demand for townhouses and condos. Homebuyers, on the other hand, can expect more competitive prices for properties as developers scramble to get a bigger piece of the pie. Needless to say, it remains to be a great time for Filipinos to invest in properties. Payment terms are becoming friendlier with several housing loan options offered by banks and financial institutions. Choices are diverse too with homes and condominiums sprouting almost everywhere. The big question that comes to mind is “Where should I invest my money?” Should it be a house or a condo unit? Here’s an infographic comparing a house and a condo to help you determine the most suitable property, be it for your own use or investment Is There Really a Real Estate Bubble?

As income rises in a growing economy, consumers tend to buy more property, usually with the intent of flipping (buying low and selling high) or for a personal–and more stable–investment. This strong demand for property moves prices up in the face of limited supply. These are the warnings of a real estate bubble. With prices continuing to shoot up, more and more people will buy properties believing that property values will just continue to rise. This will soar the prices even higher to the point where the bubble pops: properties become so expensive that consumers can’t afford them while buyers default on their housing loans. If you are investing in a property, the idea of a bubble is a nightmare scenario because it translates to an increase in your mortgage payments. If you haven’t been approved for a loan, this also means that it will be harder for you to get one as lenders become more stringent to recover money they have loaned to other borrowers. In a report by the Bangko Sentral ng Pilipinas dated January 11, 2017, BSP Deputy Governor Diwa Guinigundo downplayed the idea of the bubble and said that, “At this point we don’t see any signs of stress in the real estate sector.” In a nutshell, their stress shows that “we are far from the so-called danger level.” Final Thoughts Amid the rumors and the hysteria of an impending real estate crash, it’s important to make decisions based on hard numbers and data. With experts across the industry agreeing that there is a huge deficit in supply of properties over demand, it’s safe to say that the bubble is nowhere in sight, at least for now. When purchasing property, weigh the pros and cons of a condo and a house before sealing the deal with your real estate agent. Once you’ve decided, remember that you don’t need to cough up the cash immediately to pay for the property. You can take advantage of friendly home loan terms and financing options that’ll let you get the keys to your dream house or condo sooner rather than later. [source]

1 Comment

12/22/2021 10:52:05 pm

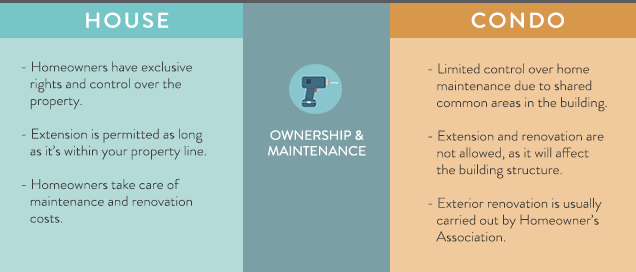

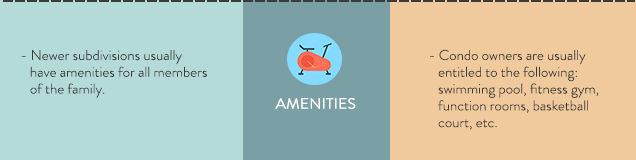

I love how this article did a comparison between a house and a condo property in terms of maintenance and ownership, lifestyle and location, price, amenities, and privacy and security. Whichever one's chooses, any would be profitable and it all depends on how good the homeowner cares for his or her <a href="https://www.goldensphere.com.ph">property investment</a>. Price continues to increase as years go by - considering its historic data and all.

Reply

Leave a Reply. |

About UsWe are a group of professionals that specialize in condominium selling and leasing, with an extensive experience in project development and management... Read More →

Office Address:

Unit M2 West of Ayala Condominium, Gil Puyat Ave., Makati City Iloilo Satellite Office: Savannah, Oton, Iloilo Aklan Satellite Office: Osmeña Ave., Linabuan Sur, Banga, Aklan |

Quick Links |

Contact UsSales Hotline:

Manila: (02) 8511-8606 Western Visayas Sales Hotline: Mobile: +63 908 8926467; +63 908 8606407; +63 917 8387363 Email: [email protected] |

REB Lic. #0000884

Member, Philippine Association of Real Estate Brokers QCRB Member, Management Association of the Philippines (MAP) |

|

© 2016 Properties Around the Corner Philippines All Right Reserved

|

|

RSS Feed

RSS Feed